UPI One World Wallet Service: UPI One World Wallet Service started in India, making payments will be easy...

The UPI One World Wallet service has been launched by the National Payments Corporation of India (NPCI) for non-resident Indians (NRIs) and international travelers visiting the country. The service was first announced last year during the G20 summit hosted by India. It will allow travelers who do not have an Indian bank account to access and use the Unified Payments Interface (UPI) system to make payments. The initiative was launched by NPCI in collaboration with IDFC First Bank and Transcorp International Limited under the guidance of the Reserve Bank of India (RBI).

NPCI, in a post announcing the service, said travelers visiting India will be able to make secure digital payments with the UPI One World Wallet and transact with merchants and vendors across the country. The service will help travelers avoid the hassle of carrying large amounts of cash or making multiple foreign exchange transactions.

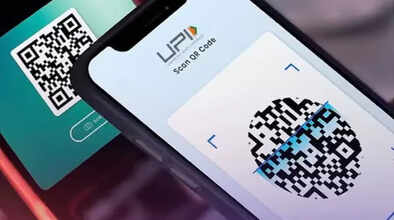

With the UPI One World Wallet service, foreign travelers and NRIs will be able to download a prepaid payment instrument (PPI)—the UPI app. After this, users will be able to scan the QR code of any merchant with their smartphone camera to make payments.

Travelers can also make online transactions with their UPI ID. NPCI said that UPI One World Wallet can be used for merchant stores, hotels, and restaurants as well as online shopping, entertainment, transportation, travel booking, and many other things.

To avail of this service, users have to get the PPI-UPI app from authorized issuers across the country. Once the app is issued, travelers can load the amount of INR in the app as per their choice. Any unused amount will be transferred back to the source as per foreign exchange regulations. This initiative aims to make travel and stay in India seamless for international visitors.

How to use UPI One World service:

First, download the app provided by the issuer and sign in.

Complete your Know Your Customer (KYC) process by physically verifying your passport, valid visa, and other details at the issuer counter.

Once completed, the individual will be issued UPI One World on his/her international mobile number.

The traveler can then exchange the foreign currency at the issuer counter or load INR value in the app using a credit or debit card.

The app can then be used to make UPI payments.

Follow our Whatsapp Channel for latest update