SBI has reduced interest rates on this special RD scheme, now how much investment will have to be made to become a lakhpati, see full calculation

SBI Har Ghar Lakhpati Scheme: SBI, the country's largest government bank, runs a special RD scheme for its customers, in which by investing a very small amount every month, you can save lakhs of rupees without any additional burden. However, now SBI has announced a 0.20 percent cut in the interest rates offered in this lakhpati-making scheme (SBI Har Ghar Lakhpati Scheme). This means that customers will now have to invest a little more money monthly than before.

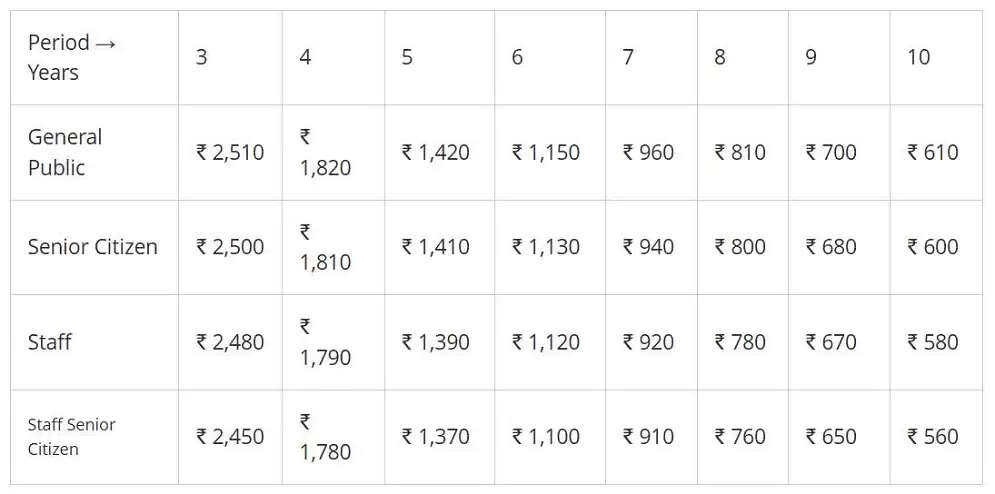

SBI's Har Ghar Lakhpati Scheme is a recurring deposit (RD) scheme. In this RD scheme, customers can invest for a tenure of 3 years to 10 years. Customers can choose it according to their convenience. Your RD installment is determined according to the tenure and you get Rs 1,00,000 on maturity. If you choose a tenure of 10 years, then general people can start investing with just Rs 610 and senior citizens with Rs 600.

Any Indian citizen can invest in this scheme. The scheme offers the opportunity to invest both singly and jointly. Minors can open an account alone (above 10 years of age and able to sign clearly) or with their parents/legal guardians.

This RD scheme of SBI has a tenure of 3 years to 10 years, you can choose it according to your convenience. According to the tenure, the installment of RD has to be paid every month and on maturity you get Rs 1,00,000.

How much installment for how many years of RD?

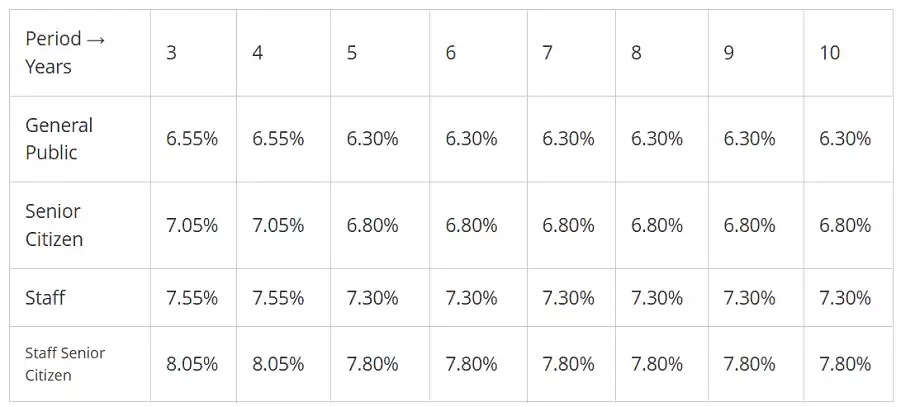

How much interest is there on RD for how many years?

If for any reason 6 consecutive installments are missed, then the account will be closed prematurely and the balance amount will be transferred to the account holder's savings account.