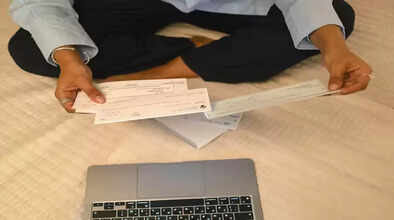

If you see these 2 lines drawn in the corner of the cheque, then understand that... Know when and why this is done.

Everyone does banking, but there are very few people who use cheques. Many people do not even know about different types of cheques. One such cheque is a cross cheque. In this, two parallel lines are drawn on the left side upper corner. Do you know why these lines are drawn? Let us know every detail of cross cheque according to the Negotiable Instruments Act 1881.

According to section 123 of the Negotiable Instruments Act 1881, the person issuing the cheque tells the bank that it is a cross cheque through two lines drawn on the left side corner of the cheque. The special thing about this cheque is that you cannot go to any bank and withdraw cash with it.

Crossing a cheque ensures that the payment from it will be made only in the bank account. This payment can be made to the person whose name is written on the cheque. That person can also endorse the cheque to someone, for which it becomes necessary for him to sign on the back of the cheque.

There are many types of cross-cheques. The first is general crossing, in which two lines are drawn on the edge of the cheque. Whatever we have discussed about cross cheques so far comes under general crossing only.

According to section 124 of the Negotiable Instruments Act 1881, special crossing is done when the person issuing the cheque wants the money to be paid to the person should go to his account in a particular bank only. Suppose the person to whom the money is to be paid has accounts in many banks. In such a situation, the person issuing the cheque can write the name of the bank by drawing two parallel lines in the blank space at the bottom of the cheque. In such a situation, money can be deposited through that cheque only in the account of the bank whose name is written on the cheque.

If Account Payee (A/C Payee) is written between the crossing lines in the cheque, it means that only the person whose name is written on the cheque can withdraw money from his account. He can withdraw money by depositing the cheque in any bank account. However, if the name of a bank is written while doing special crossing, then the money will go only to that bank. The most special thing about this cheque is that it cannot be endorsed by anyone. Its money will go only to the account of the person whose name is written on the cheque. Let us tell you that there is no mention of it in the Negotiable Instruments Act 1881, but many banks follow this practice. It is also mentioned on the HDFC Bank website.

The purpose of issuing a crossed cheque is only that the amount of the cheque should go to the person to whom the cheque issuer wants to give it. In such a situation, even if the cheque falls into the wrong hands, he will not be able to withdraw money from it. That is, crossing the cheque increases its security.