Government banks gave a shock to crores of customers; made loans expensive, knowing how much interest would have to be paid

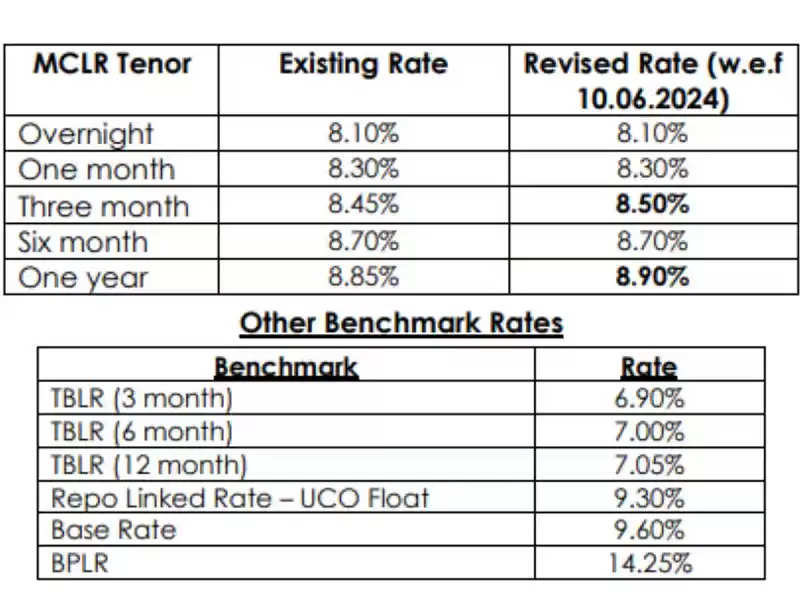

UCO Bank MCLR Hike: Government bank UCO Bank has given a big shock to its customers. The bank has increased its MCLR i.e. Marginal Cost of Fund based rates from June 10. The bank has increased the MCLR by 5 basis points i.e. 0.05%. This increase has been done on the tenure of 3 months and 1 year. Now the maximum lending rate from the bank has become 8.90%.

How much has the interest rate increased?

The bank has not made any change in the overnight and one-month lending rate. Overnight and one-month tenure lending rates are stable at 8.10% and 8.30% respectively. At the same time, the three-month MCLR has increased by 5 basis points to 8.50%. There is no change in the 6-month MCLR and it remains at 8.70%. The rate on 1-year tenure has been increased from 8.85% to 8.90%.

When will the new interest rates be applicable?

These new interest rates will come into effect from June 10, 2024. Let us tell you that before this, government banks Indian Bank and Punjab National Bank (PNB) have also increased their Marginal Cost of Funds Based Lending Rates (MCLR). The bank has changed the MCLR rates for a period of 3 months to 3 years. The new rates have become effective from June 1, 2024. At the same time, Indian Bank has increased the marginal cost lending rates by 5 basis points.

Follow our Whatsapp Channel for latest update