CBDT Notifies New ITR-Form 6: Key Changes and Who Benefits

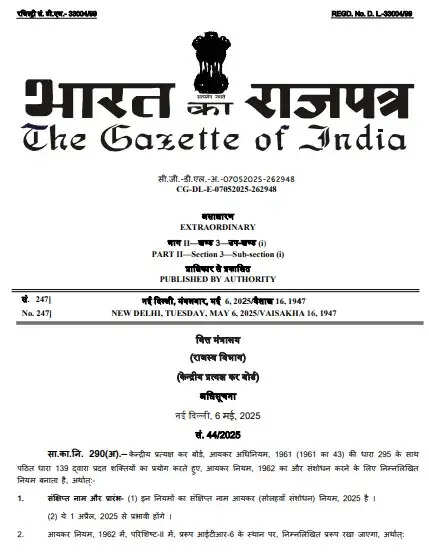

In a major development aimed at simplifying corporate tax filing, the Central Board of Direct Taxes (CBDT) has notified the revised ITR-Form 6. As per the official Gazette notification dated May 6, 2025 (GSR No. 290(E), Notification No. 44/2025), the new format is effective from April 1, 2025, for the assessment year 2025-26.

Who Will Use the New Form?

The new ITR-Form 6 applies to all companies except those claiming exemptions under Section 11 of the Income Tax Act, 1961. The changes have been implemented under powers conferred by Sections 139 and 295 of the Act, via the Income-tax (16th Amendment) Rules, 2025.

6 Major Changes in the Revised ITR-Form 6

CBDT announced six key changes in the new ITR form on its official X (formerly Twitter) handle. Here's a breakdown:

-

Capital Gains Segregation

Capital gains are now to be reported separately for periods before and after July 23, 2024. The entire Schedule II format has been revamped accordingly. -

Recognition of Capital Loss from Share Buyback

Companies can now report capital loss arising from share buybacks if the related dividend income is shown under 'Income from Other Sources.' However, this applies only to losses incurred after October 1, 2024. -

Detailed Disclosures Required

Companies will need to disclose key information such as PAN, CIN (Corporate Identification Number), and the date of incorporation. -

Company Classification & Name Change

Entities must now specify whether the company is domestic or foreign. Additionally, companies must declare if they have undergone a name change. -

Business Start Date & Contact Details

The form requires disclosure of the date of business commencement, registered office address, contact number, and email ID. -

Other Technical Amendments

-

Section 44BBE (related to cruise business) has been clarified and referenced.

-

Under Schedule BP, Rule 10TIA now mandates reporting of profits from rough diamond sales if they exceed 4% of gross receipts.

-

Modifications have been made to incorporate deductions under Section 24(b).

-

TDS reporting formats have also been revised for greater accuracy.

-

Kind attention Taxpayers!

— Income Tax India (@IncomeTaxIndia) May 7, 2025

CBDT notifies ITR-Form 6 for AY 2025-26 vide Notification No. 44/2025 dated 06.05.2025.

Key updates:

🖋️ Schedule-Capital Gain split for gains before/ after 23.07.2024 (post changes in Finance Act, 2024)

🖋️Capital loss on share buyback allowed… pic.twitter.com/xbu0O5VYT7

Why This Matters for Companies

The revised ITR-Form 6 aims to enhance transparency, ensure better compliance, and align with evolving regulatory standards. The broader disclosures and updated schedules are designed to help tax authorities maintain tighter oversight while simplifying the tax filing experience for corporates.