'Buy Now, Pay Later' is making you bankrupt! It is having a huge impact on your pocket, are you also making this mistake?

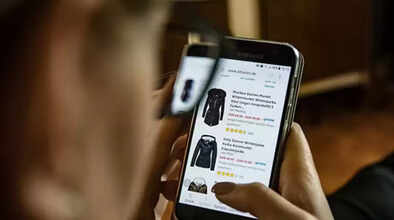

“It is only worth Rs 2000, I will pay next month”… Buy Now Pay Later (BNPL) and buy the goods now without making any payment and pay later in EMIs. This sounds like a smart method, but in reality, it affects both your pocket and mind slowly. In the beginning, it seems that you are getting EMI without interest. Everything is happening without paperwork, through mobile.

But the trick hidden behind this system is very soft and silent. And by the time you understand, many EMIs have already piled up.

Why can BNPL be a danger to you?

It changes your spending habits. While using BNPL, you stop asking yourself “Can I buy this?” Now you start thinking “Can I pay this month’s EMI?” This change seems small but has a big impact. When we buy something, we hesitate a bit. But BNPL eliminates that hesitation. Then you keep buying one thing after another on EMI.

Missing a small EMI can spoil your credit history.

Do not take BNPL lightly. It is not a game. It goes into your credit report. If you miss an EMI of even Rs 499, you may not get a call, but your CIBIL score falls. And when the score falls, it affects not only the loan but your entire financial life. Like high interest rates, low credit limits, and rejection in many places.

Late fees slowly eat into your pocket.

You thought the EMI was only Rs 1999. But a late fee of Rs 100, then Rs 300, and gradually the same EMI becomes Rs 2599. This is not freedom. It is like forcibly picking your pocket, which goes on very slowly and without making any noise.

This is how BNPL becomes your habit.

Even if it starts with a shirt. Then the same option on mobile, then food apps. Slowly you start considering borrowing for everything as normal. Now you are borrowing not for need, but for desire. This method always keeps you one step behind, not forward.

How can you get out of this habit?

You do not need to please any app, trend, or Instagram influencer. You need to make decisions for your peace of mind. And it starts with breaking this BNPL cycle.

First ask yourself the truth, how many BNPL EMIs are running in your name right now? 2? 5? Or have you forgotten the count? Open your apps, check your email, and make a list. Unless you know yourself, improvement is not possible.

Whatever you can pay, pay it immediately.

If no EMI is due yet, do not wait. Finish paying off that Rs 1800 pair of sneakers. Stop paying off that third earbud loan. Every EMI is not just a dues, it is an open tab on your mind. Close it. Lighten your mind.

Think “Do I need it?” instead of “How to buy it?”

If you have to buy something worth Rs 2500 on EMI, it probably isn’t that important. And if it isn’t important, you can wait. This thinking can save you from regrets. Every time you avoid BNPL and deposit money yourself, you are building financial strength. This feeling is better than any instant checkout.

You get caught in the trap of this system because it is designed to be seamless. Its sole purpose is to not let you realize your mistake. Don’t hold the guilt, but be smarter going forward. Avoiding borrowing is taking back control. And once you have that control, it is priceless.

Disclaimer: This content has been sourced and edited from NDTV India. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.