5-5-5... Just remember these 3 numbers, whether you are 25 or 30 years old- This trick of PPF will give you 1 crore 54 lakh 50 thousand 911 rupees

The real magic of PPF starts after 15 years; its "5-5-5" rule unlocks the power of compounding when the account is extended to 30 years. This is the trick that transforms your total investment of ₹45 lakh from earning unmatched interest to a huge and completely tax-free fund of ₹1.54 crore.

Whenever it comes to investments with safe and guaranteed returns, the name of Public Provident Fund (PPF) comes first. This is a government-backed scheme that not only keeps your money safe, but the interest received on it and the maturity amount, everything is tax-free.

But most people forget PPF thinking that it is just an investment with a lock-in period of 15 years. They do not know that the real magic begins after 15 years. Today we are going to tell you such a magical trick of PPF, which is called the "5-5-5 rule". If you understand this, whether you are 25 or 30 years old, you can create a tax-free fund of more than ₹ 1.54 crore by retirement.

What is this magical rule of "5-5-5"?

This is not a complicated formula, but a very simple but powerful feature of PPF.

First 5

PPF account matures in 15 years. After this you can extend it for 5 years.

Second 5

After completion of 20 years, you can extend it again for 5 years.

Third 5

After completion of 25 years, you can extend it once again for 5 years.

Total: 15 years (original) + 5 years + 5 years + 5 years = 30 years

This trick gives your investments the real power of compounding (interest on interest), which makes your money grow at rocket speed.

The complete calculation of ₹1.54 crore: See the calculation

Now let's come to the question you want to know the answer to. Where did this figure of ₹1.54 crore come from? For this calculation, the official PPF calculator of India Post and SBI has been used.

For calculation, we have considered the following parameters

Annual investment:

₹1,50,000 (PPF maximum limit)

Interest rate:

7.1% per annum (current rate, we have considered it constant for 30 years)

Investment period:

30 years (with "5-5-5" rule)

| Milestone | Total Investment | Approx. Final Amount |

|---|---|---|

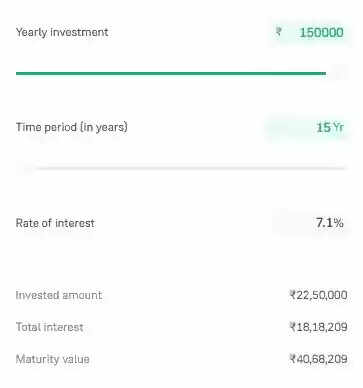

| After First 15 Years | ₹22,50,000 | ₹40,68,209 |

| After 20 Years (First 5-Year Extension) | ₹30,00,000 | ₹66,58,288 |

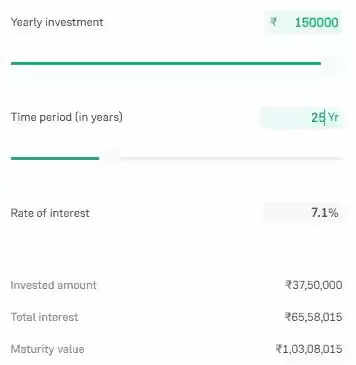

| After 25 Years (Second 5-Year Extension) | ₹37,50,000 | ₹1,03,08,015 (Become a Crorepati!) |

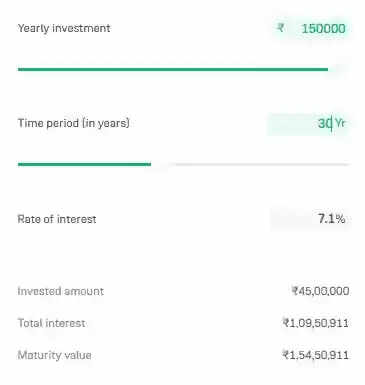

| After 30 Years (Third 5-Year Extension) | ₹45,00,000 | ₹1,54,50,911 |

Let's see this journey step by step.

Maha Muqabla: 15 years vs 30 years of power

One thing is clear from the above table—the real game happens in the last years.

In 15 years:

You invested ₹22.5 lakh and your fund became around ₹40 lakh.

In the next 15 years:

You invested another ₹22.5 lakh, but your fund grew from ₹40 lakh to ₹1.54 crore.

You see, your fund grew by ₹1.14 crore in just the second 15 years. This is the power of compounding, where your money starts earning money for you.

Why is PPF a no-brainer investment?

Zero risk:

Government guaranteed, your money is 100% safe.

Triple tax benefit (EEE):

Tax exemption on investment, no tax on interest, and the entire amount received on maturity is also tax-free.

Disciplined savings:

The habit of putting money every year makes you financially disciplined.

Start small:

You can start with just ₹500 per year.

Conclusion

Becoming a crorepati is not a game of rocket science, but the result of patience and discipline. PPF's "5-5-5" rule shows you such a straight and safe path. If you are in your 25 or 30s, start investing in PPF today and pledge to stick to it for 30 years. When you look at your account at the age of 60, this tax-free fund of ₹1.54 crore will bring a relaxed smile on your face.

Frequently Asked Questions (FAQs)

Q1. Can I invest more than ₹1.5 lakh in PPF?

A: No, the maximum investment limit in a financial year is ₹1.5 lakh only.

Q2. What if the PPF interest rate changes?

A: Your returns will change; the interest rate is decided by the government every quarter.

Q3. Can I withdraw money from PPF in between?

A: Yes, partial withdrawal facility is available from the 7th year onwards with certain conditions.

Q4. Can the account be extended even after 30 years?

A: Yes, you can extend it any number of times in blocks of 5 years each.

(Disclaimer: Interest rates on investments in PPF are changed by the government from time to time. This calculation is based on the current rate of 7.1%. Please consult your financial advisor before making any investment.)