Big news for those making payments using UPI: SEBI's new system has been launched, learn what's special.

The Securities and Exchange Board of India (SEBI) has taken a major step to curb online fraud. SEBI has introduced the @valid UPI handle and SEBI Check system.

SEBI UPI New System: While easy access to the internet and technology has made people's lives easier, cases of online fraud are also increasing steadily. The Securities and Exchange Board of India (SEBI) has taken a major step to curb online fraud. Investors use UPI to invest in mutual funds and the stock market. Keeping this in mind, the Securities and Exchange Board of India (SEBI) has taken some important steps to curb online fraud. This will help investors transfer their funds to authorized brokers and institutions registered with SEBI.

Learn about the @valid UPI handle and SEBI check.

Under the @valid UPI handle, SEBI will assign a unique UPI ID to its registered brokers and mutual fund companies. This ID will have two key features: the ID will begin with @valid, indicating SEBI accreditation. Additionally, the entity will be assigned a unique identification symbol. The symbols brk for brokers and mf for mutual funds are designed for identification. For example, a broker's ID would look like xyz.brk@validsbi, and xyz.mf@validsbi for mutual funds.

SEBI Check Tool

Under the SEBI Check Tool, investors can check a broker's UPI ID before transferring funds by visiting SEBI's Sarathi app or the SEBI website. This UPI ID is created using the broker's @valid UPI ID, account number, and IFSC code. SEBI says these steps are being taken to prevent fraud and simplify investment payments.

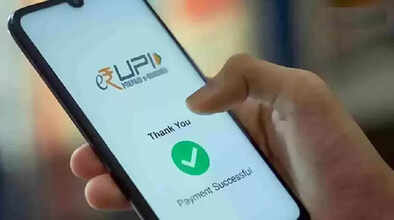

Sebi has also made the system completely user-friendly and added some important features to ensure security. Features like visual confirmation have been added. Whenever you make a payment to a SEBI-authorized broker or institution using a @valid UPI ID, a thumbs-up symbol will appear in a green triangle on the payment screen.