Late ITR filing will attract a penalty, interest will increase, and you will lose many tax benefits.

Income Tax Return Due Date: The last date for filing Income Tax Return (ITR) for the financial year 2024-25 has been extended to 15 September 2025. Delayed returns can be filed till 31 December 2025, but there will be a risk of penalty, interest and loss of tax benefits.

Income Tax Return Due Date: The last date for filing Income Tax Return (ITR) for the financial year 2024-25 (assessment year 2025-26) is near. Earlier this deadline was fixed as 31 July 2025, but now it has been extended to 15 September 2025. Tax experts say that this time there is no possibility of further increase, so taxpayers should file returns on time.

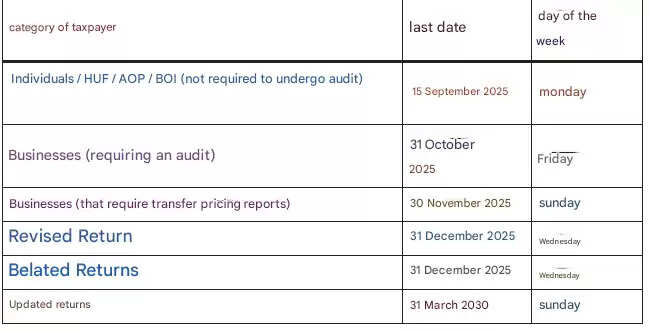

New last dates for ITR filing (FY 2024-25, AY 2025-26)

Penalties for late filing of ITR

If a taxpayer fails to submit his ITR within the due date, he can file a belated return under section 139(4). However, this comes with certain penalties and interest:

Section 234A charges interest at the rate of 1% per month on the outstanding tax.

Section 234F charges a penalty of Rs 5,000 if the income exceeds Rs 5 lakh.

If the income is less than Rs 5 lakh, the penalty will be Rs 1,000.

Delayed filing of returns will also result in loss of certain tax benefits, such as capital loss or business loss carry forward to the next years. Similarly, exemptions under sections 10A, 10B, 80-IA, 80-IB, 80-IC, 80-ID and 80-IE will also be affected.

How to file late ITR?

Step 1: Login to the Income Tax e-filing portal.

Step 2: Go to the ‘e-File’ tab and click on ‘Income Tax Returns’ > ‘File Income Tax Return’.

Step 3: Select the assessment year (AY 2025-26).

Step 4: Select ‘Online’ as the mode and click on ‘Start new filing’.

Step 5: Select your status (Individual/HUF/Company) and the relevant ITR form.

Step 6: Check and verify personal details.

Step 7: Select section 139(4) in the filing section.

Step 8: Fill in all your income details, calculate tax and complete the payment.

Disclaimer: India Employment News does not give any advice for any purchase or sale related to the stock market. We publish market related analysis quoting market experts and brokerage companies. But take market related decisions only after consulting certified experts.